The benefits of being self-employed are hard to ignore.

read moreEmployers are 401(k) gods, basically. That's what I want you to take away.

Their matching/profit sharing are limited not to $18500/year like individuals are, but rather $55,000*.

That's right. If your employer were nice/could manage it, you could be getting $55,000 into your 401(k).

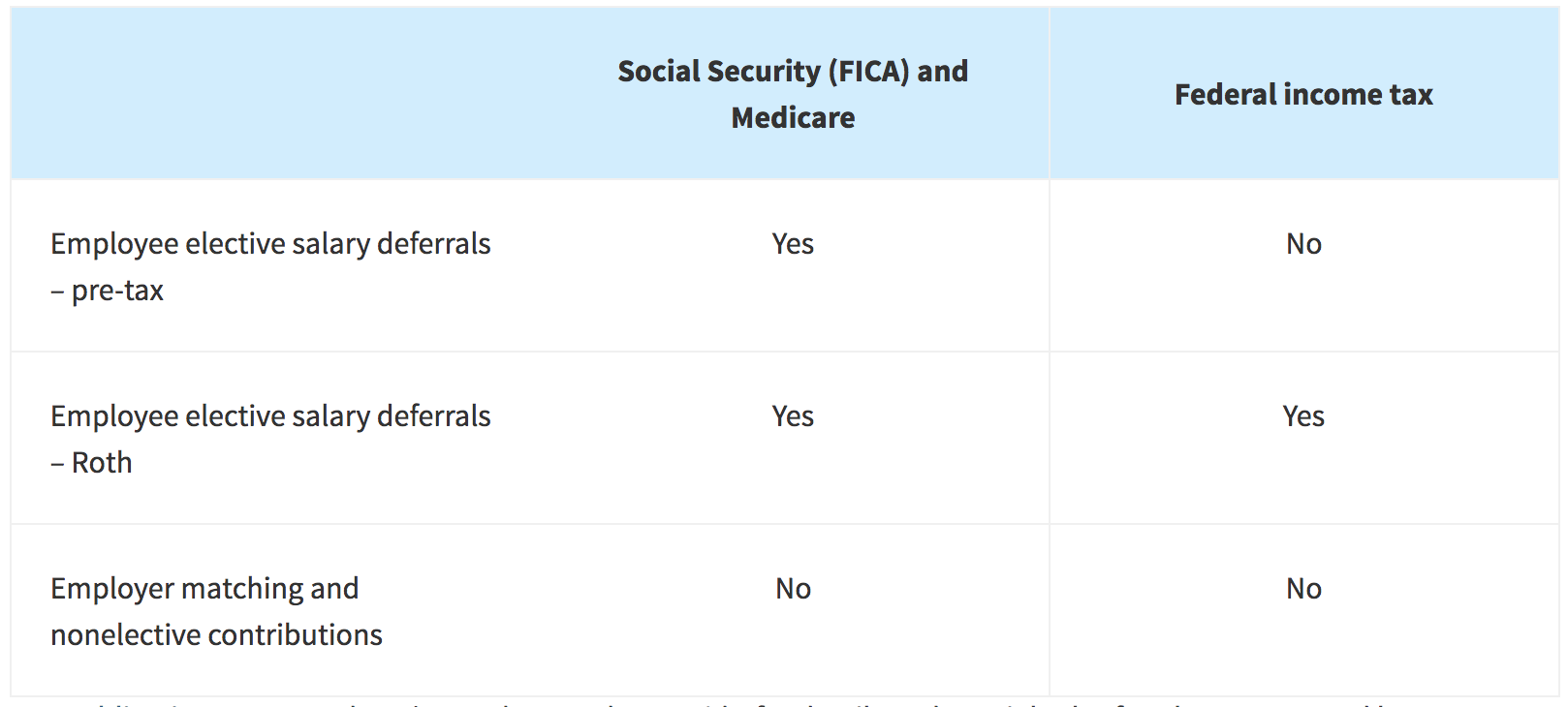

Here's the other reason why Employers are 401(k) gods: their contributions aren't subject to FICA or income taxes.

When you as an employee contribute to your 401(k), if you're doing Roth then you're paying alllll your income tax (state and federal) and then all your FICA taxes, which is about 7%. Whatever's left actually gets into your 401(k), so you may be taking a 20%-30% hit depending on your income.

If you don't do Roth, then you're only taking a FICA hit (so 7%).

But those employer contributions that can go up to $55,000? No FICA, no income tax. It's basically your employer wiring the money directly to your 401(k), no taxes applied.